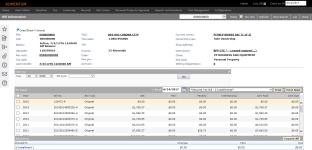

Bill Information

Navigate:  Info Center > Public Inquiry > Records Search > Public Inquiry - Tax Information > [Common Actions - Bill Information] > Bill Information

Info Center > Public Inquiry > Records Search > Public Inquiry - Tax Information > [Common Actions - Bill Information] > Bill Information

Description

View the tax detail and the detailed data on the fund allocations of the property from the Tax Information or Personal Property Information pages. The display is of the fund allocations is dynamic: selecting a different bill in the bill grid changes the data in the details grid.

You can also reprint the tax bill for bills selected. The extra-long legal bill of each bill appears in a separate window where you can send it to the printer.

Tax sale bills are included to reflect the obligation of the owner of a property that has been in a tax sale.

NOTE: To reflect potential multiple tax sales per year and to accommodate jurisdictions using e-Gov, the format for tax sale viewing/printing is:

-

Tax Sale:Sale Date

-

Tax Sale:Sale Year

-

Tax Sale Item:Certificate Number

IMPORTANT: Since eGov reach-in is affected by tax sale items, breaking changes to eGov can occur if not coordinated with the eGov teams so they can also make the necessary changes in your jurisdiction whenever any changes occur to tax sale viewing, printing, and formatting.

Two Info Center application settings define the AIN and PIN substring length on the Bill Information screen:

-

Tax Detail AIN substring length

-

Tax Detail PIN substring length

When defined, the substring value can optionally be used in external links (sidebar > Attachments > External Attachments) in context sensitivity to the particular tax bill being viewed to pull the values into defined URLs.

Jurisdiction Specific Information

Jurisdiction Specific Information

CVB

- You can remove transactions for a business by using an As of Date and recalculating the balance.

Printing Bills

Modify the list of bills that you see in the Bill Detail panel, if desired.

NOTE: Bills that are actual bills are denoted with the suffix -A. Bills that are estimated bills are denoted with the suffix -E. Estimated billing may not be available in your jurisdiction.

The as of (date) lets you set a virtual date within the tax year. For example, recreate the bill as it appeared before the due date occurred.

-

Filter the displayed bills by selecting a Tax year or all tax years.

-

Filter the displayed bills even more by selecting Paid, Unpaid, or Both.

-

Choose a bill type, if desired, such as new, original, or rollback.

-

Click Go. The bills that match your filter criteria display in the Bill Detail panel.

-

-

Print one or more bills in the Bill Detail grid:

-

Select an as of date on the grid title bar to see what the numbers would be on a different date, including future dates.

-

Select the format for printing the tax bill. Both actual and estimated (for example, Truth in Taxation) formats may be listed.

-

Click Print to print the selected tax bills as of the date and the year shown. The tax bill appears in a separate window. If there are multiple bills, they are shown consecutively as pages within the viewing window.

-

Click the X in the upper right corner to close the top window. The Aumentum Bill Detail window is again active.

-

-

Click Expand All to view the allocations detail in the Allocations panel. Alternatively, click on a + (plus) to expand the tree view line by line. You can view allocation charges, paid, and due amounts down to the fund level. Scroll as needed to see all data. Click a - (minus) to fold the tree again or click Hide All to collapse the entire tree.

Tips

The default bill form is set up in the Maintain Tax Bill Types screen.

The default display format for the bill (such as PDF) is set up for your user profile in Security and User Maintenance.

Statements are set up as a bill type in Aumentum Billing, using Info Center as an available module. The statement then is an option to print in the list of available bills.

The tax year of the information is displayed above the Legal Description panel. You can change the tax year by clicking there. The effective date is not used here.

The bill type is from the systype Tax Bill Type.

Tax statements are printed from the Year/Bill panel of Tax Information.